This is a sponsored post written by me for T. Rowe Price. All opinions are my own.

Give your kids the tools they need to make smart money decisions using Money Confident Kids® website.

It has always been a huge priority to me to teach my kids about money. My goal is to send them out into the world with the tools they need to make wise financial decisions.

This goal has always been a little daunting. I mean, how do you teach them everything they need to know about investing, retirement, saving, budgeting, etc. There are just so many important subjects, where do we even start??? How will we ever cover it all??? Anyone else feel this way?? Just me???

This is exactly why I was SO happy to find the Money Confident Kids website. All of my worries have been answered, and I finally feel like I have found the perfect resource to help my kids learn money smarts.

What is Money Confident Kids?

Money Confident Kids is a completely free (yes, free!) website created by T. Rowe Price. This website was built to give parents and educators the tools they need to help kids gain financial wisdom.

Money Confident Kids has 5 detailed lessons to help you teach kids about money. The lessons are: Goal Setting, Decision Making, Money and Inflation, Asset Allocation, and Diversification Simplified.

Each lesson includes a series of exercises and activities to help your children understand every concept. These activities include hands on games and worksheets. The activities are both fun and educational, making everyone happy!

Who is this for?

There is honestly something for everyone on the Money Confident Kids website. Even I learned a thing or two (for real)!

The lessons are geared for kids ages 8-14. You will find information beneficial to kids who don’t know anything about money and for those who are more knowledgeable.

I have been using Money Confident Kids this week to teach my three kids (ages 7, 11, 14) a few important money lessons. I thought I would share some of their favorite parts.

My 7 Year Old

My 7 year old is still very much a beginner when it comes to money. He already knows that we can’t buy everything we want and that it’s important to save, but he still doesn’t understand all of the reasons why.

So, I helped him set up a savings goal and went through a few of the Decision Making Activities. My son especially loved this heads and tails game where he learned why it is important to always make wise money choices.

My 11 Year Old

I went over a few different lessons for my 11 year old. She especially enjoyed the object lesson about inflation. It was so much fun to see that little light click on in her head.

This brought up a very good discussion about how to plan financially for the future and what to expect in regards to inflation.

My 14 Year Old

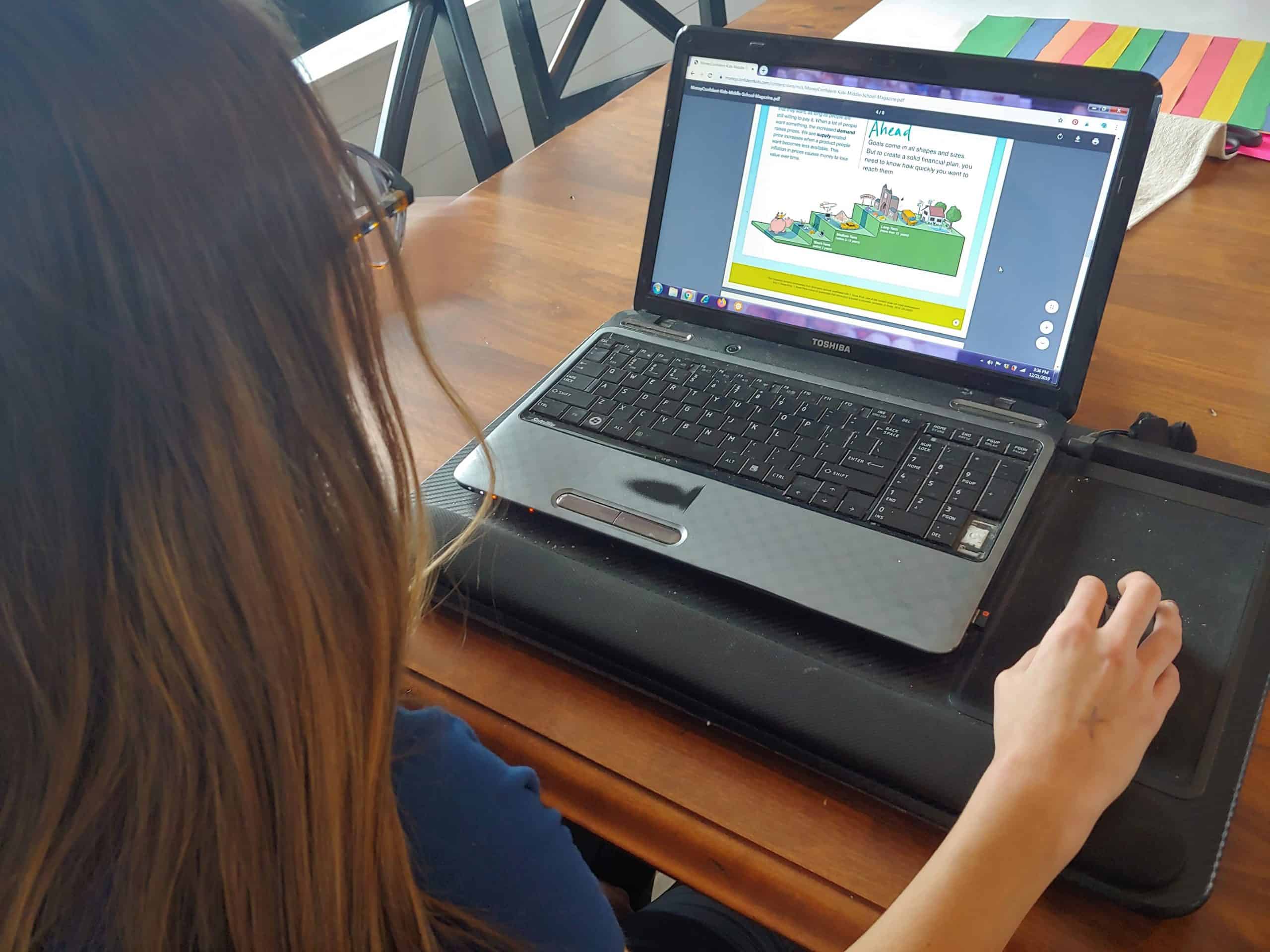

I allowed my 14 year old to look through the website on her own. Fortunately, she already knows a lot about saving and spending and has proven time and time again to make wise money choices.

She especially enjoyed the Money Confident Kids Middle School Magazine. The graphics were visually entertaining and truly taught the skills on her level. She was so shocked when she read the section, “Twin Tales of Spending” and asked some good questions about it afterwards.

How should I use Money Confident Kids?

I could not believe just how much free and helpful content is available on the Money Confident Kids website. It’s more than just a cute little parents guide, it is a complete guide to take you from start to finish as you prepare your kids for the real financial world.

For Educators:

Use Money Confident Kids to assist you as you prepare money lessons for the classrooms. You can teach each lesson step by step or pick and choose a few favorites here and there to supplement your

This is seriously the best resource for parents. Everyone should be able to pick out one or two (or in my case allll of it) to help your kids understand money concepts.

Here are a few ways to implement them into your family’s routine:

- Choose one night each week as “Money Night.” Go through one of the lessons together as a family discussing each part to ensure understanding.

- Pick one or two activities that you feel will be most beneficial to your kids. Sit down together one night and go through those activities while relating it to their lives.

- Use a school break (such as summer vacation) to go through each of the lessons with your kids. This could easily be added to a morning routine.

- If you homeschool start a unit on money education. Use this website as part of your money curriculum.

We decided to go through the Money Confident Kids website during my kids Christmas break. I picked out a few lessons for each of the kids and spent a few hours going through the different activities and discussions with them.

My kids weren’t thrilled with the idea when I first brought it up. But, once we got started they found they actually enjoyed the info more than they thought they would. Plus, they learned a lot! Huge win in our household!

What I love about Money Confident Kids.

There were so many things I loved about Money Confident Kids!

I think my favorite part though was the fact that these lessons were taught in ways that each of my kids could easily understand the concept. The free hands on activities made these lessons a breeze to teach, and gave me new ideas that I had never thought of before.

What I dislike about Money Confident Kids.

I always want to present my readers with an honest, unbiased view of the items I review. Mostly, as a way for you to see the whole picture and make the decision for yourself if it sounds like the right fit for you.

In this situation I could only think of one thing (seriously, only one) I didn’t like about the Money Confident Kids website, and that has to do with access to the printables.

I was truly excited to print out everything they offered, but being able to do so wasn’t easy. It took me a while to figure out how to print them at the right scale, it involved reopening the image in a new window, saving it to my computer and then printing it out. I think a user friendly instant download option would be much more convenient. With the help of my husband, we were able to figure it all out eventually, but it was a little more time consuming than just clicking and downloading.

In Conclusion

If you are unsure where to start when it comes to teaching your kids about money, start at Money Confident Kids. This gives you everything you need to raise your children to make smart money choices today and every day!

Leave a Reply