How to use envelopes for budgeting.

I remember when I first heard about the cash envelope system years ago. I was so judgmental, so snobby about the whole idea.

“Ew! What a stifling way to live,” I responded to my husband.

Fortunately, I have grown up (a lot) since then. I now use cash envelopes proudly. There is no shame on my face as I pull out money from each envelope and love being able to pay for my purchases with zero guilt.

It was a few years ago when I finally changed the way I was spending money. I decided to quit using my debit card for purchases and try only using cash.

I’ll be honest, I did not think this change would make much of a difference. I am a little bit prideful, and a lot of stubborn, and I really felt that I was strong enough to spend smartly with my debit card.

It only took one month of paying with cash to realize that I was so so wrong! I couldn’t believe how quickly my wad of cash depleted. It was a huge wake up call as I watched my cash fly out of the envelope in what felt like an instant.

I still use my credit card on a lot purchases….it does EARN me money after all. But, I try to use cash on everything else. It’s a bit of a hassle, but I know that it saves me a lot of money.

If you are looking for ways to cut back and have more money in your bank account, today I’m sharing with you how the cash envelope system will help you do just that!

Why Use The Cash Envelope System?

As I mentioned above, cash envelopes will help you have more money in your bank account. Why, you might be asking….well, I will tell you why!

1. Cash Envelopes Force Discipline

Once your envelope full of cash is gone….it’s gone! There is no card to swipe, no back door to take. You simply have no more money for that category.

When I first started using cash envelopes I felt like I had plenty of money at the beginning of each period, so I spent freely.

And, I couldn’t believe how quickly that cash flew out the window. I found myself with empty cash envelopes waiting impatiently for payday.

Did I want to keep spending? Absolutely! But, I couldn’t. There was literally no money to spend. This forced me to be disciplined, I had no other option.

2. Cash Envelopes Are Visual

If you are a visual learner, you will really benefit from using cash envelopes. Watching the cash go from bank, to envelope, to hand, and then to store is very humbling.

It shows you how quickly you might be spending money, and how fast the cash goes. For some reason it’s not very hard to swipe a credit card….but it’s very hard to visually watch cash leave my hand (anyone else agree???).

3. Cash Envelopes Are a Proven System

The cash envelope system has been used by hundreds of thousands of people for years….and it’s still popular.

The reason?

Because it WORKS! I have heard of countless number of stories over and over again of people who have seen success while spending with cash, who have gotten out of debt, grew their savings and more. All because they implemented cash envelopes.

Start With a Budget Meeting

If you are not already having a regular budget meeting, it’s time to schedule one.

A budget meeting is the time when you and your partner (or this can be done by yourself) will sit down and discuss the budget. You will look through the previous months budget, discuss any successes and failures, and then make a new budget for the upcoming month.

- Related: How to Make a Zero Based Budget

Schedule this into your calendar, otherwise….they probably will not happen! We like to have our budget meeting on the last Friday of every month.

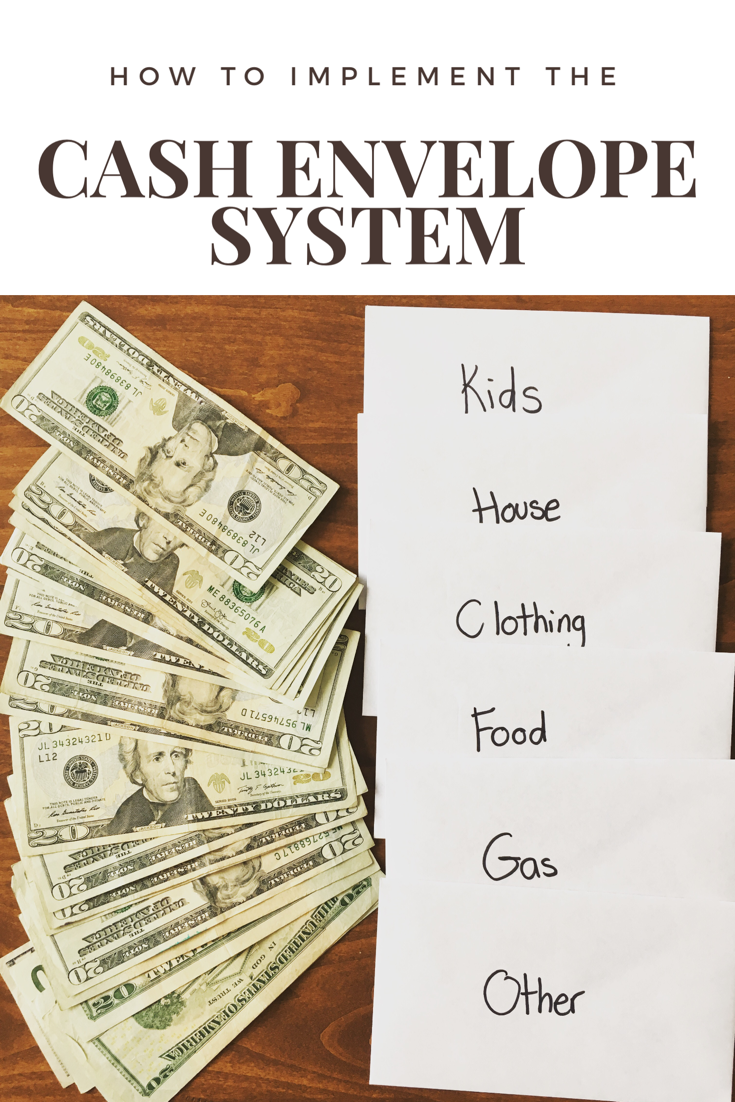

Setting Up Your Cash Envelopes

The budget meeting is also when we decide how much money we will put in each cash envelope for the new month. The cash envelope categories change regularly, based upon what needs/expenses we currently have.

Our most common cash envelopes are: clothing, house expenses, pet food, children’s extra curricular activities, groceries, fun and other.

We also have an “other” category for any extra expenses that come up throughout the month. We have NEVER had a month go by without something coming up that we forgot to budget for. Always make sure you have an “other” envelope.

Once you have your budgeted amount, go to the bank, withdraw the amount of money you will need and start stuffing my envelopes (this is the fun part!).

You do not need fancy envelopes, you can use them if you want….but they are not necessary. We use boring cheap white envelopes and just write the names of each category on the front.

Now that you have your cash, simply put your budgeted amounts into it’s corresponding envelope. So easy!

Making Cash Envelopes Work

This money will need to last you for the entire time of your budget. In many cases this will be paycheck to paycheck, we budget our cash monthly.

Remember to watch these envelopes closely. Spend with caution and be aware of any upcoming expenses you might have later on in the month.

To track my cash spending I like to use a simple note card, stuffed into my envelope alongside the cash. This is my “mini-budget” where I take note of all expenses and income for that particular envelope (yes, one note card per envelope).

Once the month (or pay period) is over you will repeat the process.

If you have any extra money in your envelope you can do a few different things with it.

1. Keep It There

You can keep the extra cash where it’s at, and for the next month you will have MORE money in that envelope. This is a great way to save up for something big.

2. Use It Wisely

If you have debt that you are trying to pay off, or any big expenses, you can use this extra cash to help you reach your goals quicker. Throw that money at your debt, or contribute to your retirement fund. Use it in a way that will help you most!

3. Spend It

Even frugal people love to treat themselves every now and then. If you have extra cash leftover, there is nothing wrong with buying yourself a little reward. We all need to celebrate!

Cash Envelope FAQ

Do you still have questions about cash envelopes? I get it! Here are a few of my most asked questions, and how I answer them.

Do you worry carrying around that much cash?

I definitely don’t just leave this amount of cash laying around for the world to see. But, I have never worried much.

The cash envelopes stay home 90% of the time. The only time I might bring one with me is if I need it for a particular purchase.

For example, last week I went to Target to buy my daughter some shoes. (I am a recovering Target addict by the way…..). Before I left I grabbed our “Clothing” envelope, and nothing else.

I used this envelope to pay for the shoes. And, because I didn’t have any other envelopes with me I wasn’t tempted to impulse shop. Woo-Hoo!

Can you “borrow” from one envelope for another?

Personally, I am fairly loose with the envelopes and will occasionally switch some of the cash around in the envelopes mid-month.

This probably should be a practice used sparingly, but I think it is a personal decision. Always do what works best for you and your budget goals.

What if I buy something online?

There is no getting around the fact that we live in an online world. More people are shopping online now than ever before.

You can still use cash envelopes AND shop online. Here’s how I make it work.

Let’s say I had $50 in my clothing cash envelope.

And then I spend $30 on clothes while shopping online.

I will then take the $30 from my clothing cash envelope and put it into another envelope I have labeled “bank.” This leaves me $20 for clothing.

The bank envelope sits tucked away at home, not to be touched. When the new month rolls around and it’s time to re-stuff cash envelopes I take the money from the “bank” envelope and use it to help distribute to the envelopes. Any other cash I need I will get taken out of the real bank.

I highly recommend everyone at least TRYING doing most of their spending with cash each month and see how much less you spend. It truly opened my eyes to my spending habits! Let me know if you have any questions about how to use the cash envelope system!

Pin this article for future reference:

You might also be interested in these related articles:

How to Recover your Budget From a day of Impulse Shopping

Overspending Triggers and Solutions

My mindset is naturally frugal, so I can easily use a credit card (which I pay off in full each month) for purchases and never get into trouble, BUT my husband has never met a thing (or snack!) he did not want AND he has no self-control. SO we are going to try using the envelope method for awhile to see if it can help him to learn to spend more wisely. Good tips!

I hope it works well for you guys!

This is a great explanation of the cash envelope system. We try to use Mint to track our spending and setup budgets in the tool. We usually use our debit card so we only spend what we know we have. But I can see how the physical aspect of the cash envelope system would help reinforce the idea of how much you are spending on something.

We’re switching to this system this month. Can’t wait to try it!

I hope it works for you!!

Great post! This is exactly how my wife describes how she helped her Mother manage her finances when she didn’t have a clear path or method for saving. Great common sense!